Menu

Close

Recent updates to next year’s Budget timetable and the Government’s tax policy-making process suggests that no announcement will be made on private sector IR35 reform until the Autumn Budget in November 2018 at the soonest.

In an attempt to simplify tax changes and end any confusion caused by two fiscal events per year, in a previous Budget, The Chancellor unveiled plans to hold just one annual event each November. This was explained in a Government statement to decrease the ‘degree of churn and uncertainty in the tax system.’

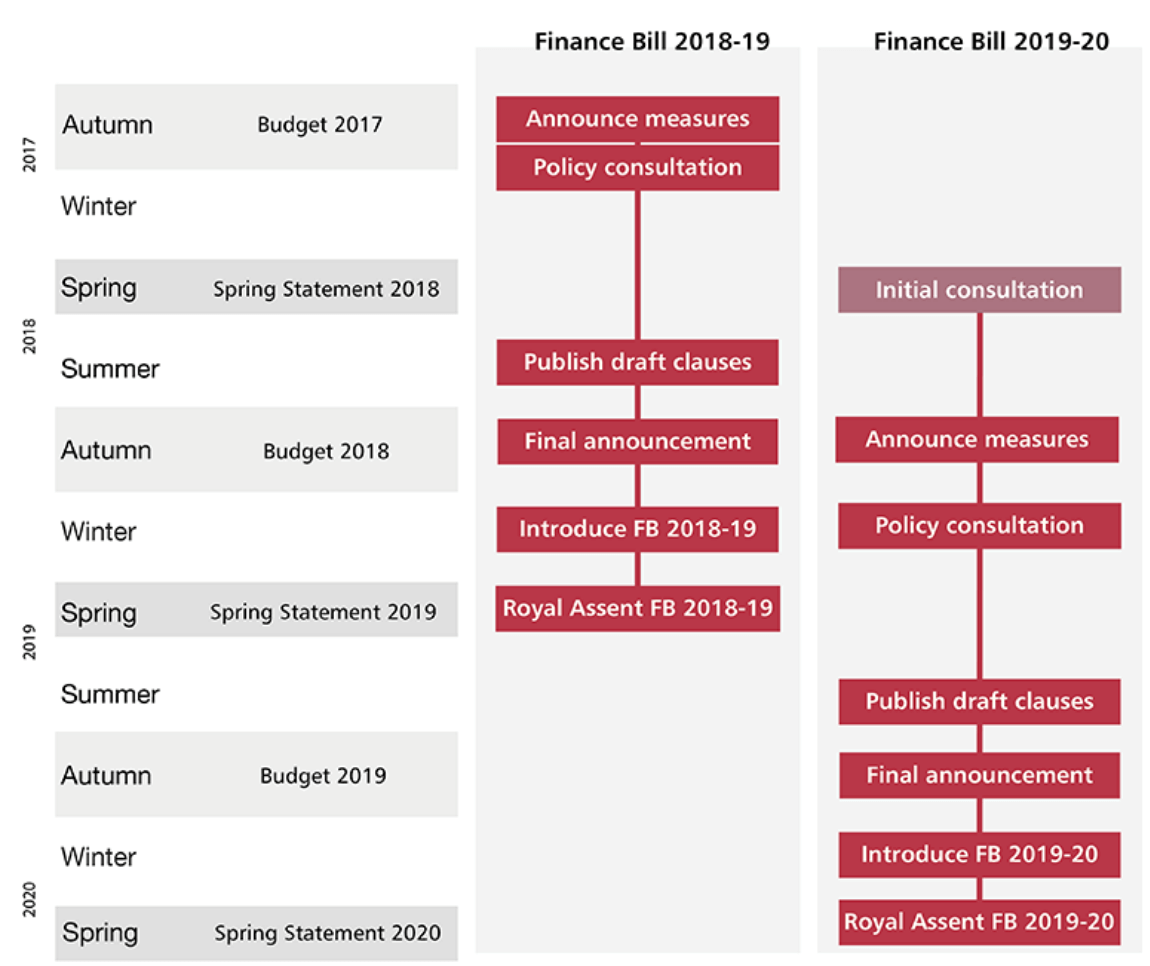

The amended tax timetable explains, ‘Policies will be announced at the Budget in the autumn, and consulted on in winter and over the spring. Draft legislation will then be published in July for technical consultation ahead of the Finance Bill being introduced in the autumn.’

Updated on 6th December, the new tax timeline indicates the IR35 consultation process could last up until summer 2018, before any new measures are then announced in November’s Autumn Budget. This confirms long-held suspicions that IR35 in the private sector will not experience changes until 2019 at the earliest.

Given that speculated IR35 reform was not published in last month’s Budget, any moves to introduce changes as early as 2018 would have been rushed through and a huge risk.

The fact that the impact of recent public sector reform is yet to be fully realised might well have played its part in the Government’s decision to hold back from making any further announcements.

There is also the residing issue that private sector companies are largely inexperienced with regards to making accurate IR35 determinations, which they would become liable for should HMRC deem them incorrect.

What might well only turn out to be a delay in further IR35 reform has been welcomed by contractors and wider business circles regardless.

Assuming that the Government still intend to roll out reform to the private sector, judging by the latest tax timetable, businesses have at least one more year to ensure they are capable of making well-informed IR35 status decisions on the contractors they engage.

That said, despite the initial relief of at least a delay, the UK’s 5.5m private sector companies and many thousands of recruitment agencies must begin preparations now to be fully equipped for predicted future IR35 reform.

The Government’s updated tax timetable:

Ask away! One of our team will get back to you!