Menu

Close

An attempt to have changes to the off-payroll working rules delayed by two years until April 2023 has been ignored, with an amendment to the Finance Bill rejected in the House of Commons.

As a result, the implementation date for IR35 reform in the private sector remains 6th April 2021. The Finance Bill has now progressed to Committee stage, meaning it is one step closer to being approved.

The amendment, tabled by Conservative MP, David Davis, proposed that IR35 reform should be postponed further in light of the failings of the IR35 legislation, as highlighted in the House of Lords report, and due to the ongoing Coronavirus crisis.

In the House of Commons, Mr Davis agreed with the Lords that the IR35 “framework is flawed” and criticised the Government for creating “zero-rights employment”, which occurs when contractors work inside IR35 where they pay employment taxes but receive no rights in return.

Whilst several MPs supported Mr Davis’s amendment, including the outspoken Sir Ed Davey, along with The SNP’s Alison Thewliss, the House authorities chose not to select it. And given the Labour Party supports the Government on IR35, according to a Tweet from Mr Davis, a vote could not be held on the issue.

Therefore, the 2021 roll-out date was accepted without division.

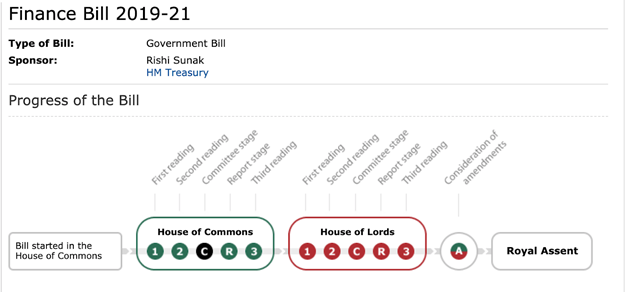

Despite the fact that the Finance Bill will be considered several more times (as outlined in the diagram below), there has been nothing to suggest that the reform will be postponed again. The Treasury’s Jesse Norman was keen to make this clear, stating “it is hard to see any genuine rationale for this further delay”, in response to Mr Davis’s amendment.

Having been criticised for the Government’s approach to IR35 reform, not least for ignoring many of the recommendations made in the House of Lords report, Mr Norman responded by announcing that further “research” into the changes will be conducted.

However, this will be carried out after the changes have been enforced next year, explained the Treasury chief: “The second piece of research, which I mentioned earlier, will come at the end, after the reform has been introduced. It will be an early take on the effects on the private sector in the first six to 12 months of its introduction.”

Needless to say, many believe this is too little too late.

For those hoping for another delay to IR35 reform, that the latest campaign to postpone these changes was ignored will be concerning. But while Jesse Norman is determined to introduce the reform next year to address what he described as the “intrinsic unfairness of taxing two people differently for the same work”, there was some hope for contractors subject to blanket IR35 determinations.

When discussing the issue of companies forcing all contractors inside IR35, Mr Norman said: “The Government have been very clear that determinations must be based on an individual’s contractual terms and actual working arrangements.”

Referencing that “actual working arrangements” must be considered not only indicates that blanket decisions are non-compliant, it also makes a stronger case for case-by-case determinations, rather than role-based assessments.

While contractual terms can be identical, actual working practices cannot be grouped together. They are individual to the contractor. Whether this was a slip of the tongue from Mr Norman or a glimpse into HMRC’s plans to address the issue of blanket and role-based decisions in future remains to be seen.

However, for companies preparing to determine a contractor’s IR35 status, it emphasises the importance of making individual assessments that examine the contract and the reality of the worker’s day-to-day engagement.

The proposed Finance Bill, that includes a 2021 IR35 reform implementation date, is now one step closer to being signed off. This means contractors, recruitment agencies and hiring organisations must ramp up their preparations and ensure they are ready for the arrival of changes on 6th April next year.

Qdos specialises in IR35 compliance. We conduct, on average, over 2000 IR35 status reviews every month and have handled more than 1,600 IR35 enquiries. We are currently working with more than 300 recruitment agencies and end-clients, helping them manage incoming changes to the IR35 legislation.

Ask away! One of our team will get back to you!