Menu

Close

As part of Qdos’ annual survey, 1,235 contractors were questioned in order to find out about their experiences throughout the year of 2021.

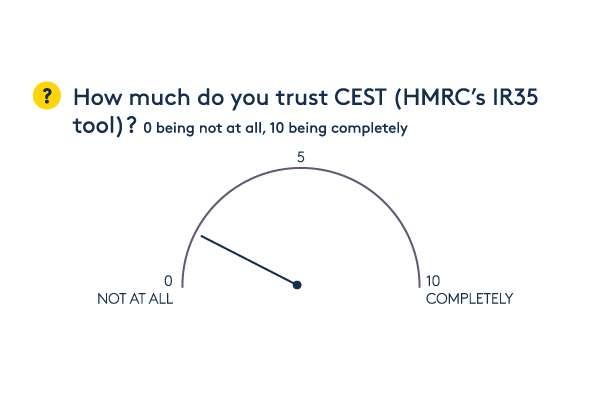

When contractors were asked how much they trusted HMRC’s CEST tool, on average those surveyed answered a 2 out of a possible 10. With 0 being not at all and 10 being completely. Even further than this, a decisive 43% reported that they would not work with, or would prefer not to work with, any company using CEST to make determinations.

Considering these statistics alongside the increasing competition for flexible and highly skilled workers, it’s evident that coasting by and simply using CEST for determinations may not be enough to attract the best contractors.

Take a look at our article ‘How to secure the best contractors in 2022’ for further guidance.

As previously mentioned, the flaws of CEST are well documented within the industry. With reasons such as myopic questions, lack of clear guidance, and their refusal to include Mutuality of Obligation proving most controversial.

CEST’s usage data revealed 410,038 indeterminate results between November 2019 and August 2021 alone. Where it did produce a result, a mere 49% of engagements assessed by the tool were deemed outside IR35. This is a stark contrast with data obtained from the Qdos Status Review facility which, following a rigorous IR35 status review, has judged that 87% of the 32,000+ contractors it has assessed on behalf of nearly 3000 businesses belong outside IR35.

More worrying still, is the speculation over how likely HMRC are to stand by any determinations made by the CEST tool. Whilst there is no clear answer to this, we can look at what we know from previous cases.

Perhaps one of the most infamous instances of HMRC not standing by the determinations of CEST, NHS Digital were handed a staggering bill of £4.3m after relying solely on CEST to complete IR35 determinations relating to their accounts for 2018/19.

More recently, HM Courts & Tribunal Services revealed that it was made to pay £12.5m to HMRC relating to its 2020/21 accounts. It was found in this instance that IR35 determinations based on answers provided by the CEST tool were incorrect.

Taking these instances into account, it is evident that HMRC will acknowledge the results of CEST when it suits them but will not allow the results of their own tool to get in the way of an IR35 win.

It is one thing to acknowledge that CEST should not be used in isolation to determine the IR35 status of contractors, but how should this issue be tackled by recruitment agencies?

Operations Director for Qdos, Nicole Slowey, provides some insight:

“With some end clients using the CEST tool without knowledge of its failings, a big threat is posed to recruiters carrying the IR35 risk. So, what is the solution?

Here are a few things that recruiters can focus on to combat this issue:

Looking for further guidance or advice? Join us at the Recruitment Agency Expo in London on the 8th and 9th of February and rethink your approach to client engagement and compliance.

Come to Stall G42 and meet our Head of Business Development, Dominic Johns, take advantage of our exclusive expo discount.

Ask away! One of our team will get back to you!