Menu

Close

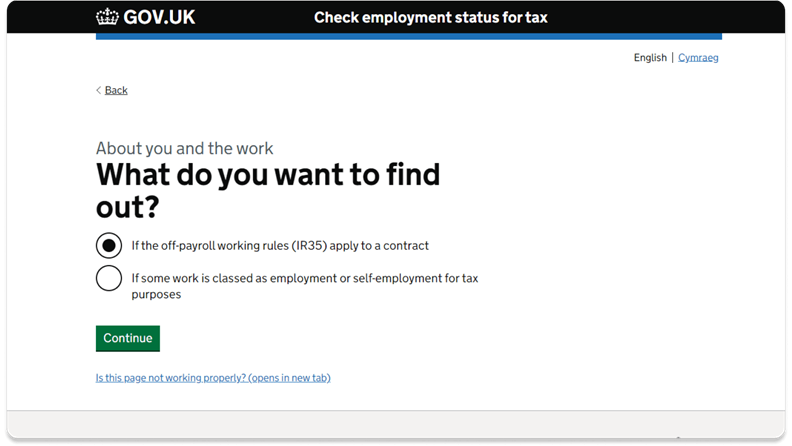

The ‘Check Employment Status for Tax’ tool (CEST) is an online tool used to help businesses determine the employment status for tax purposes of their workers.

The CEST tool was developed for the off-payroll working rules introduced for the public sector in April 2017 to assist engagers with determining their contractors’ IR35 status under the new rules, but the tool can be used by anyone in the contractual chain including contractors, agencies, and end clients.

The tool is free to use and involves just a series of multiple-choice questions before making a determination, or not providing a determination as is often the case.

The tool has been criticised heavily since its release, including the House of Lords who found the tool “not fit for purpose” and there are cases of HMRC not standing by their results.

In the 2019 case of RALC Consulting Ltd v HMRC it was HMRC themselves that applied to reject the CEST determination without even giving a reason why. This application was unsurprisingly denied but shows that HMRC won’t let a positive outcome from CEST get in the way of potential tax revenue.

CEST’s questions can be answered by anyone in the contractual chain and can be used for both IR35 and general false self-employment.

However, 20% of CEST uses result in an undetermined outcome. This means you’ll be left to work out whether IR35 applies using only the available guidance. If you’re going to use HMRC’s CEST tool, ensure you have an assessment alternative you can rely on, as well as professional support in the event of an enquiry.

HMRC promise to ‘stand by’ the results of CEST but this only applies when they’re satisfied the information used to generate the result was accurate. In some cases results given have been disregarded entirely, even by HMRC, and so users should take caution with using the tool.

See below for more information about why we don’t recommend the use of CEST for determining IR35 status.

The tool has received a number of criticisms, particularly in the early development as it was continually adjusted and launched far too close to the deadline of implementing the new rules, but there are greater issues with the CEST tool than its timeliness.

So, what exactly are the problems with the ‘Check Employment Status for Tax’ tool?

Whilst some status tests hold more weight than others, and this can be said for the status test of substitution, a test that relies on a contractor being able to provide a suitably skilled replacement where necessary.

However, HMRC have lifted the importance of this status test up so high that a contractor having, or not having, the right of substitution alone will likely pass or fail them in the eyes of the CEST tool.

In the courts however, a Judge won’t make their decision based on a single test, but based on the contract as a whole.

Did you know that CEST only provides an outcome in 80% of cases? 20% of the time it offers an ‘indeterminate’ result. This has meant that CEST has previously failed to provide an answer 223,631 times in a 20 month period and left users to work it out for themselves.

True determinations of IR35 status must be done by looking at the full picture and be based on an individual’s circumstances. CEST reduces IR35 to a series of multiple-choice questions, meaning that HMRC are failing to collect vital information that could impact the determination outcome.

It should go without saying that there must be room for users to provide more detailed answers. Where it’s appropriate for multiple-choice questions to be used, this should be backed up by the addition of a text box for additional comments or information.

We reckon it’s pretty clear that, as a tick-box exercise, CEST just can’t compete with the complete support offered by an IR35 expert.

CEST was supposedly designed with your everyday user in mind. Created to be used by those with little to no knowledge of IR35 or case law, the questions asked by the tool don’t reflect this.

Many of the questions used by the tool are easily misinterpreted, might be seen to encourage certain answers, or lack the support necessary for the average user to understand what is being asked of them. With some of the tool’s questions proving complicated enough to lead large numbers to search engines looking for a quick fix to passing CEST.

The status test of mutuality of obligation is a key indicator of IR35 status. This hasn’t stopped HMRC from ignoring it in past years when it comes to CEST. Before 2019, CEST included no mention of the status test of mutuality of obligation, after facing criticism HMRC updated CEST in 2019 to include a few questions that begin to address the test.

HMRC’s reasoning for excluding it in the first place being that the existence a mutuality of obligation is necessary for a contract to exist. This indicates that HMRC believes, or at least used to believe, that the test is no use as an indicator of IR35 status whatsoever. By looking at past case law, we know this not to be the case when it comes to Tribunal decisions.

HMRC still seems to neglect the importance of mutuality of obligation. It’s entirely possible for no questions to be asked concerning the test if the user answers the question sets a certain way. An IR35 ‘determination’ can be made using CEST that doesn’t consider mutuality of obligation at all.

There’s a whole world of options out there for accurately assessing IR35 status. Want to know how our Status Review portal stands up against CEST?

| CEST | Qdos Status Review | |

| Does it include all recognised IR35 status tests? |

||

|

Does it provide free text fields so |

||

| Approach | Algorithm/digital logic | Every submission is reviewed independently by an expert IR35 assessor |

| How often is a definitive determination given? |

80% | Always - 100% |

| Does it include Tax Liability cover for the fee-payer? |

||

| Does this include a role assessment? |

||

| Does it include dispute management? |

||

| Are all parties included in the determination process? |

||

| Does it encourage the contractual chain to work together to come to a solution? |

||

| Will there be a clear audit trail? | No - Each CEST assessment must be saved by the user |

Yes - All assessments are automatically saved in the Status Review portal |

| Does it include the issue of status determination statements? |

Ask away! One of our team will get back to you